Trump’s Goldilocks ?

Autor: Jarosław Jamka

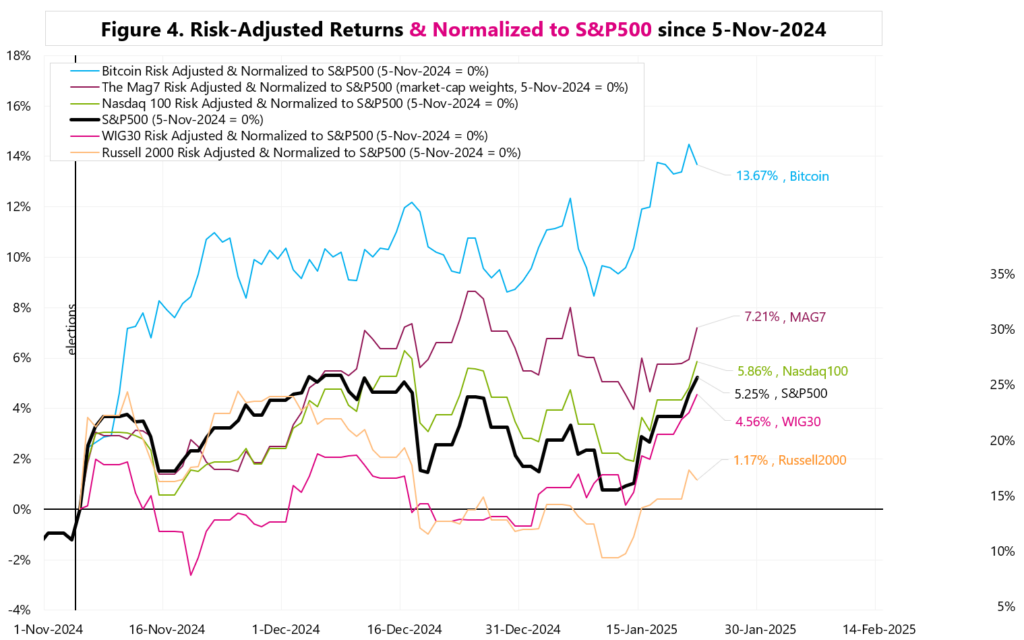

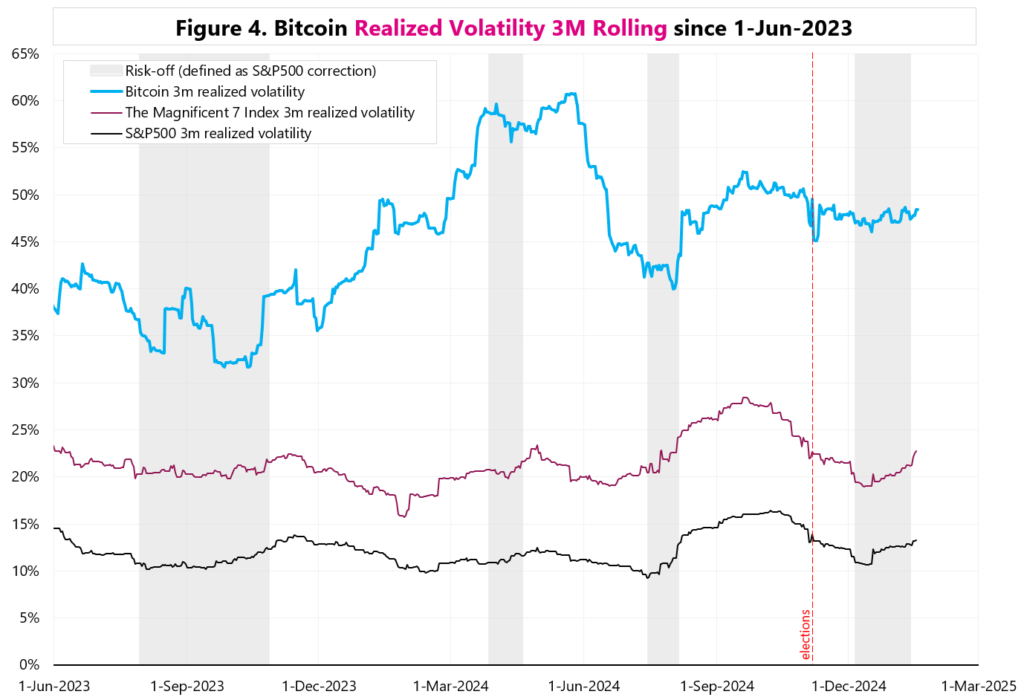

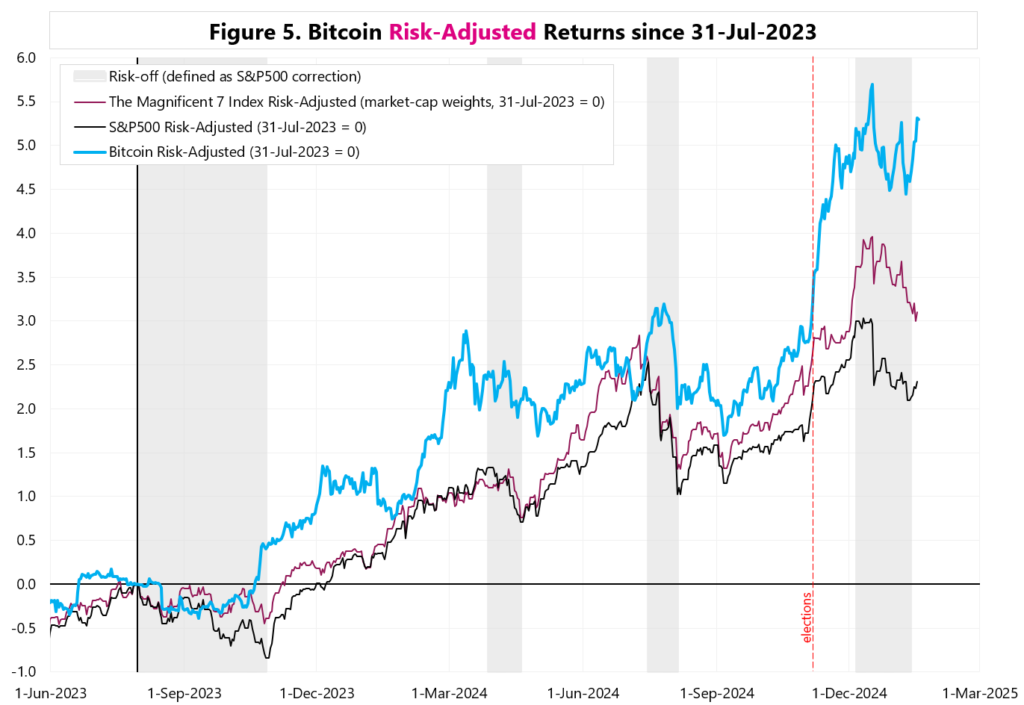

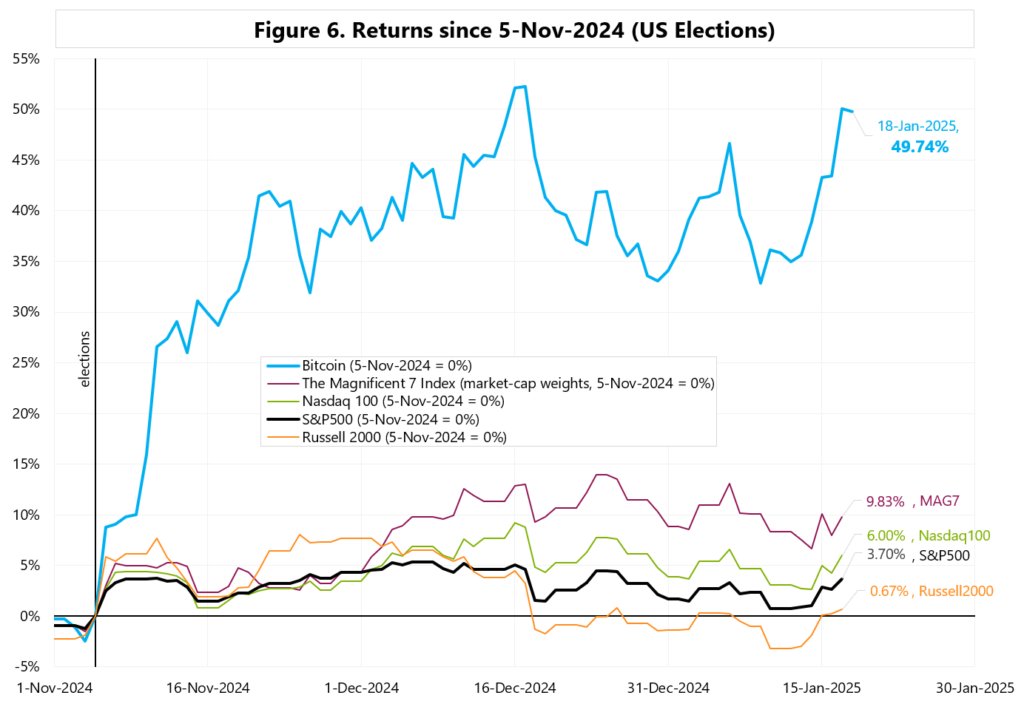

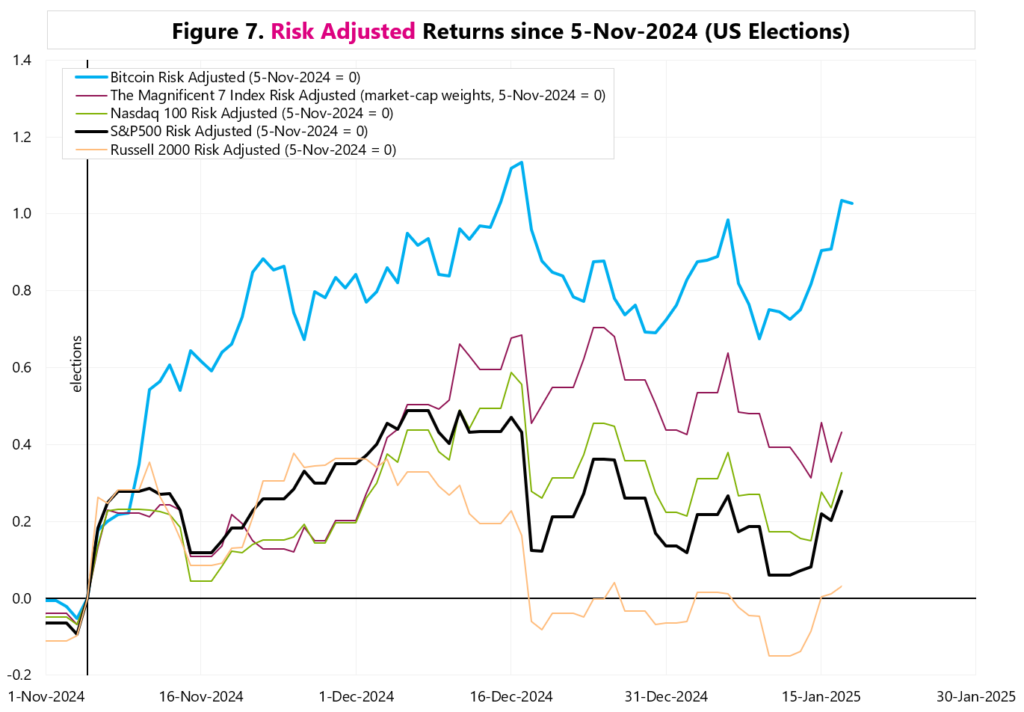

Figure 4 shows the risk-adjusted returns after normalizing to the S&P500 (e.g., although Bitcoin is up almost 50% since the election, in terms of S&P500 volatility it only means +13.7%).

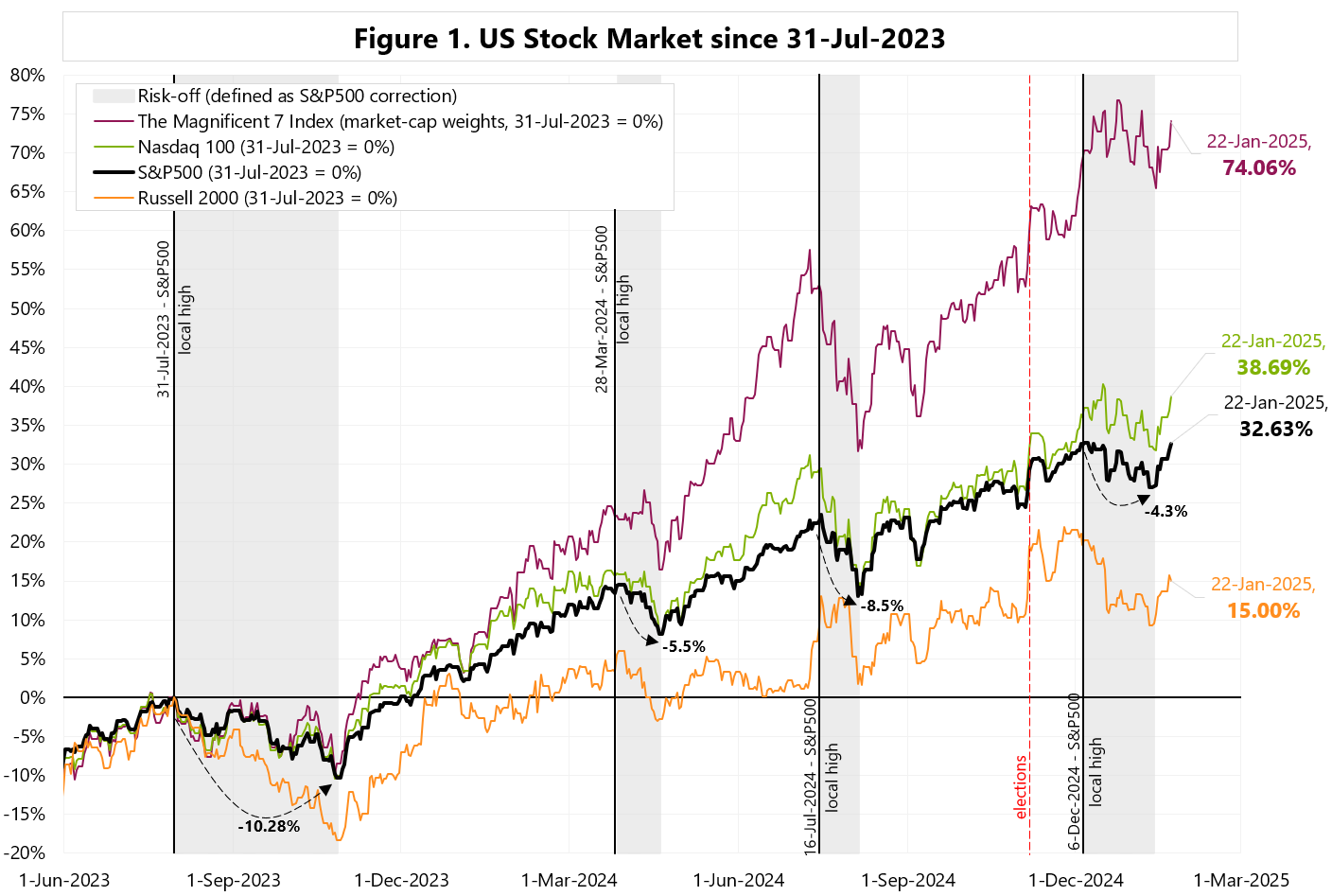

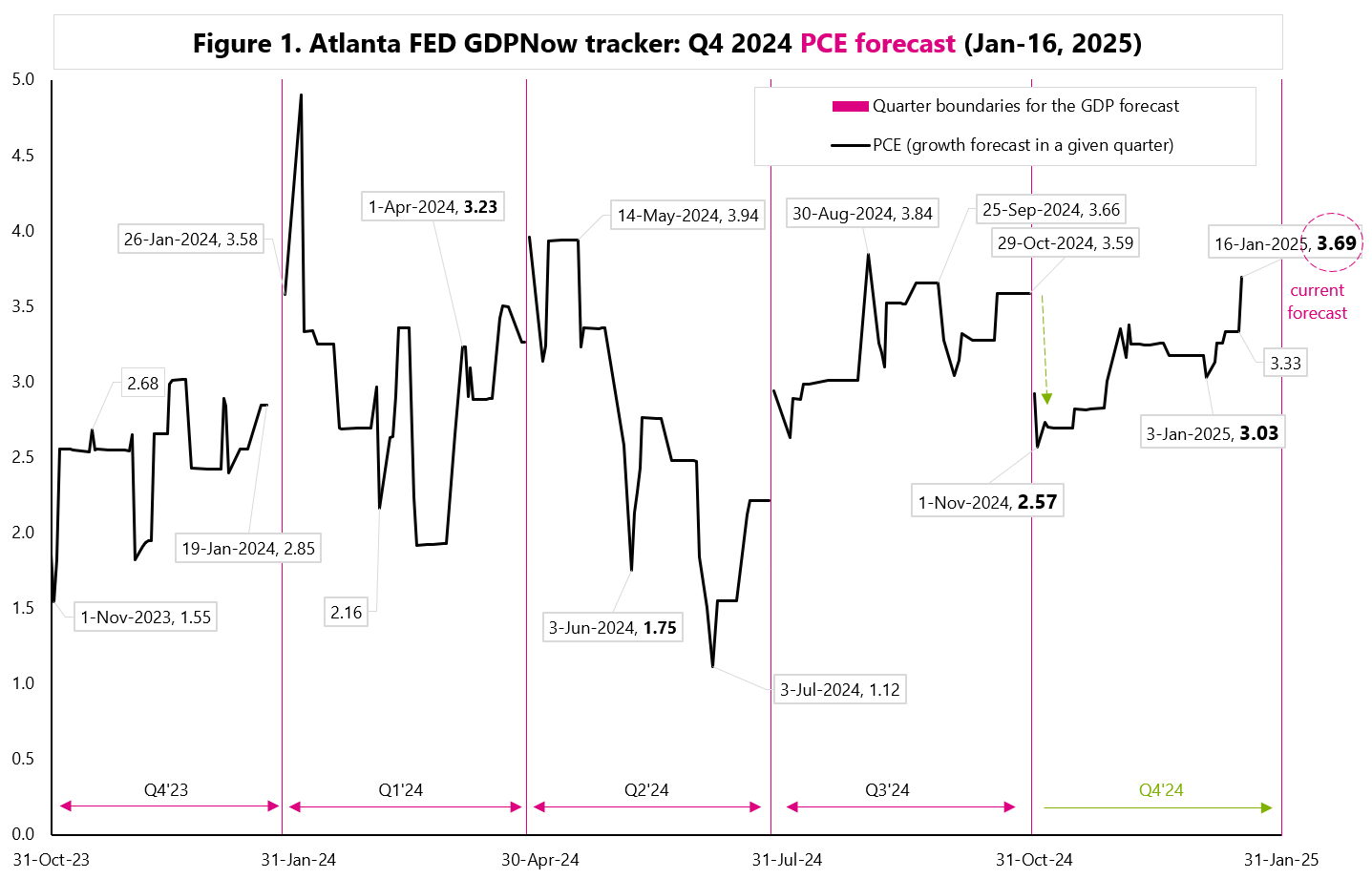

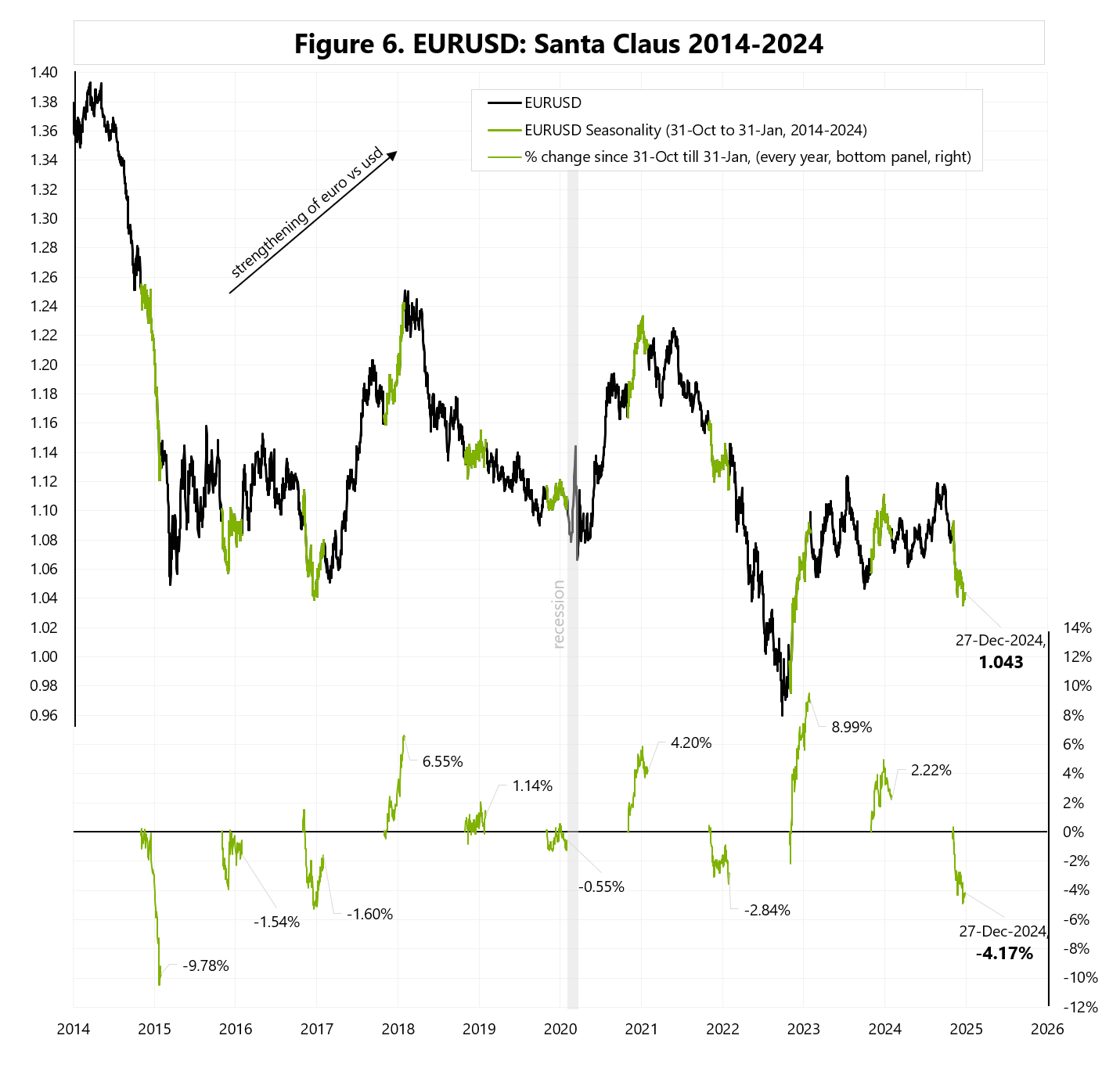

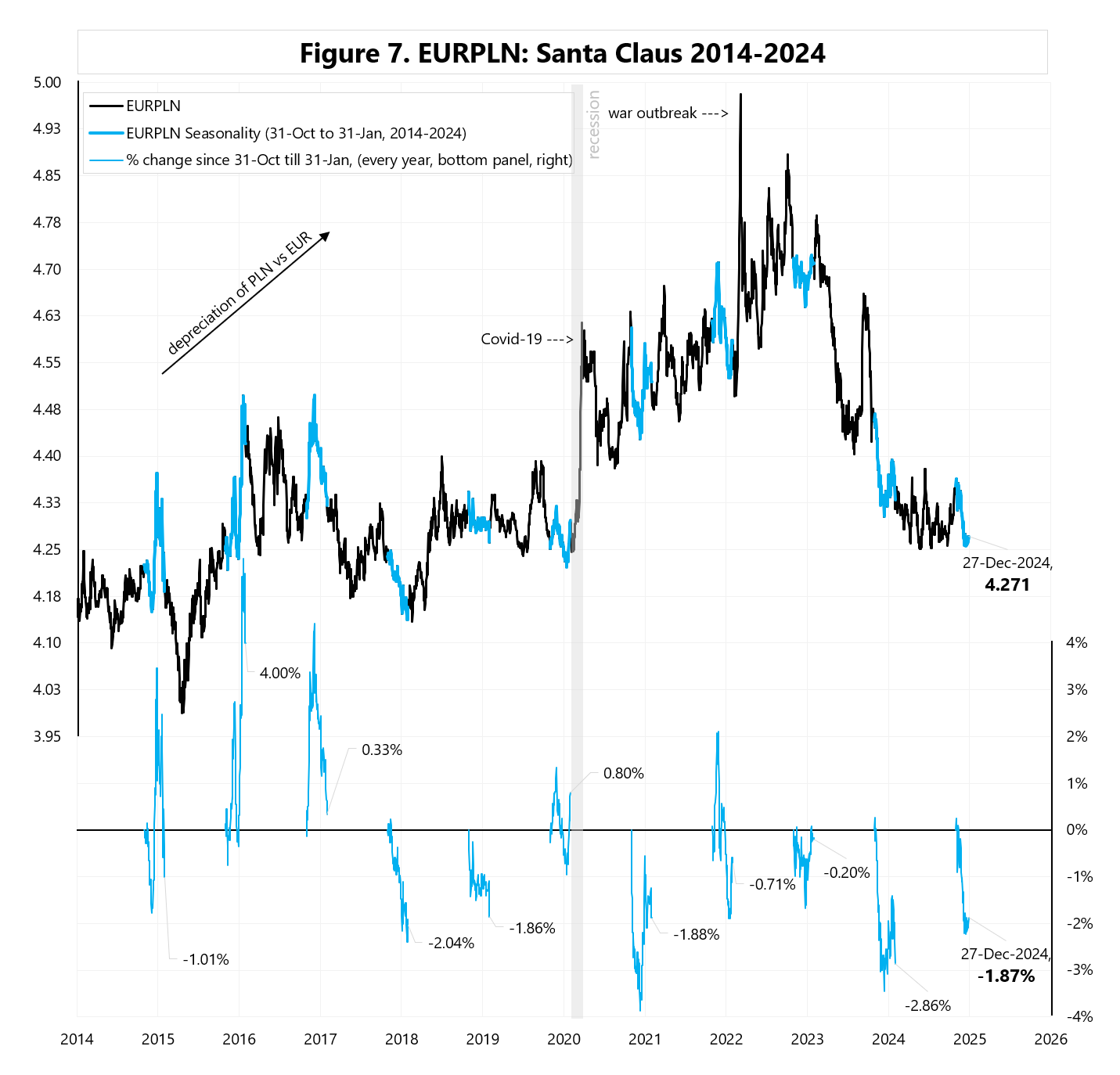

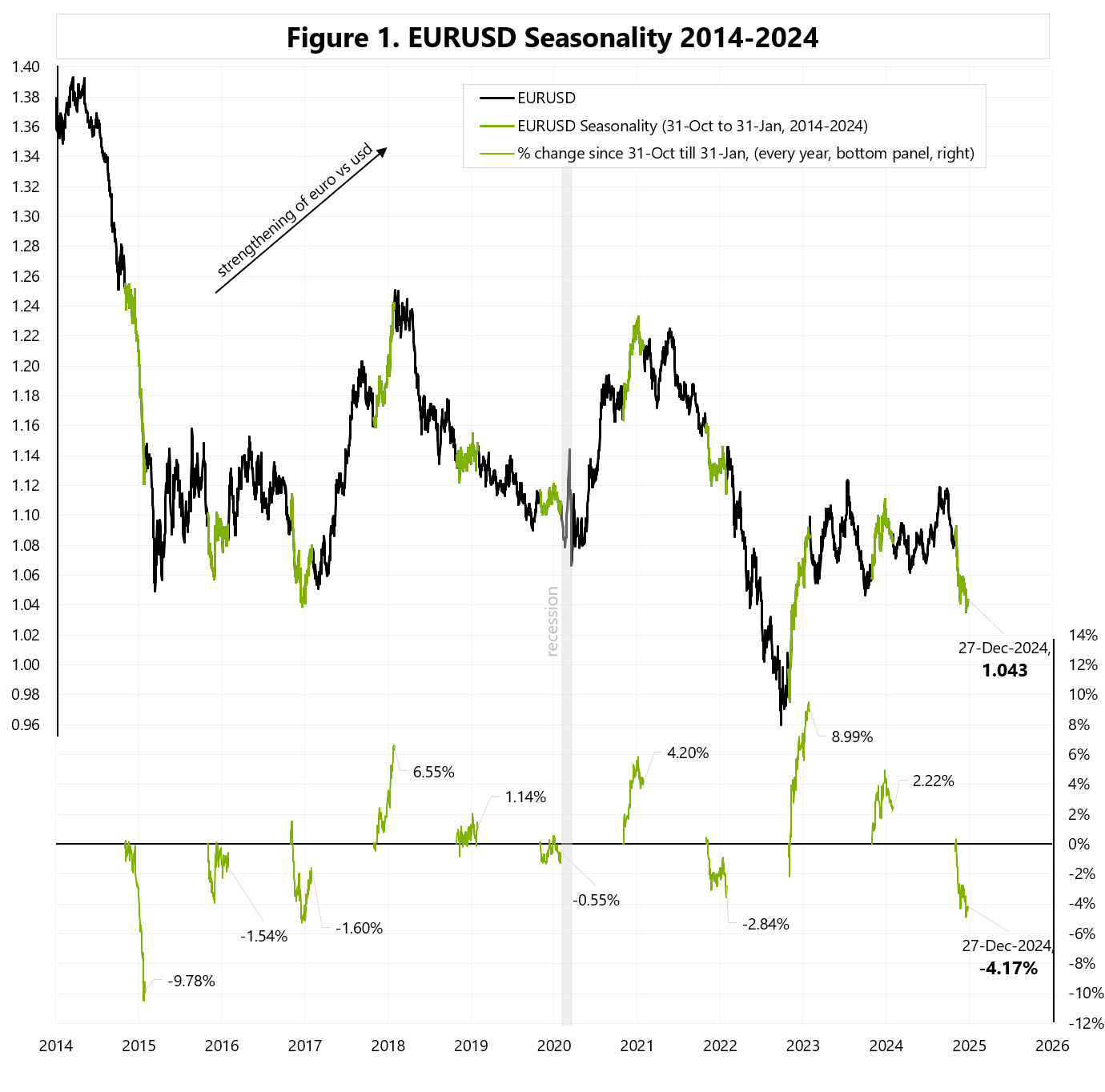

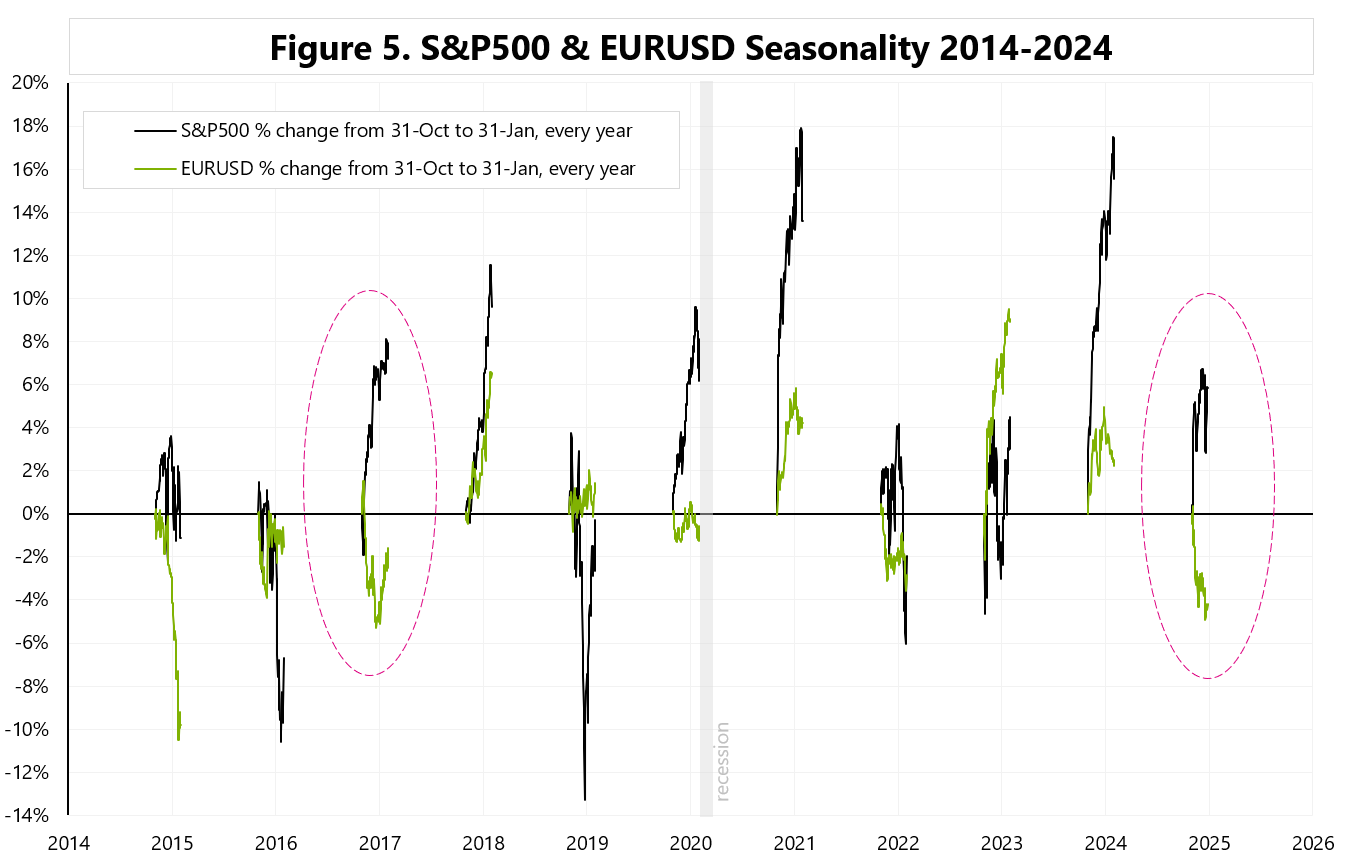

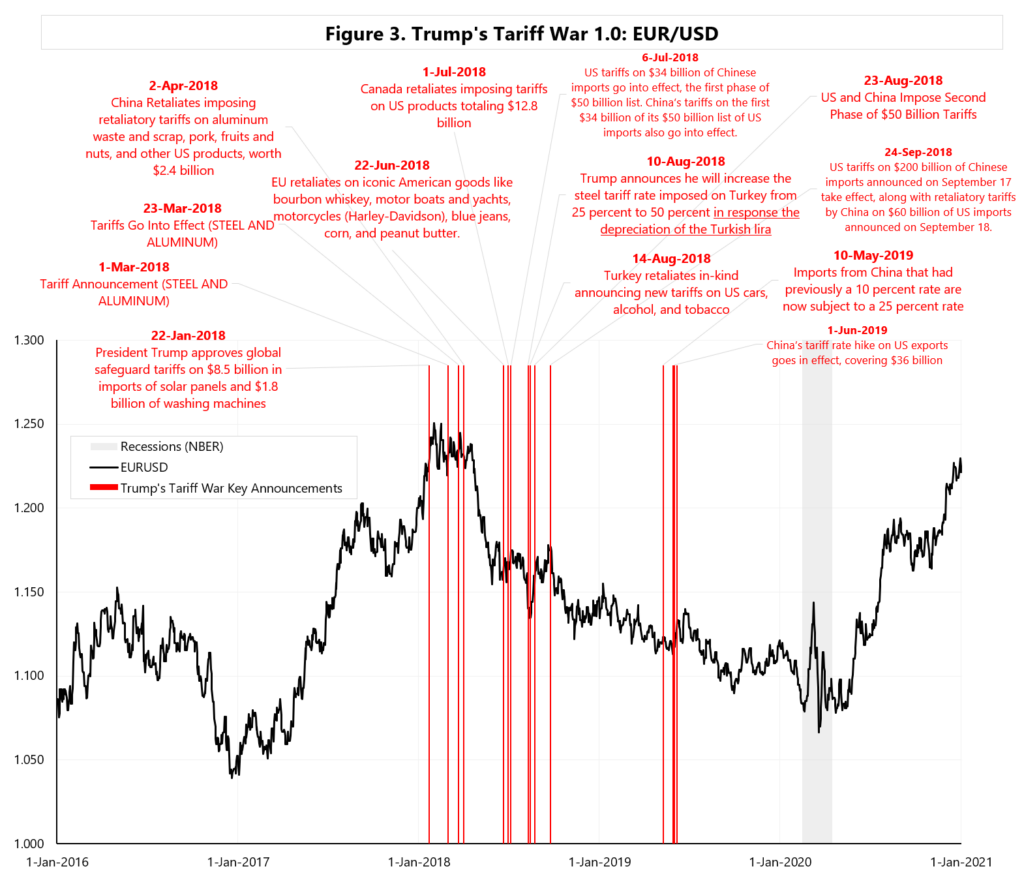

Over the past two weeks, the market has come to understand that Trump’s aggressive campaign policy announcements will not be as aggressive in real life… in other words, it looks more like a “soft Trump” version – meaning a shift towards the Goldilocks zone, as shown on the EUR/USD chart – see Figure 1.

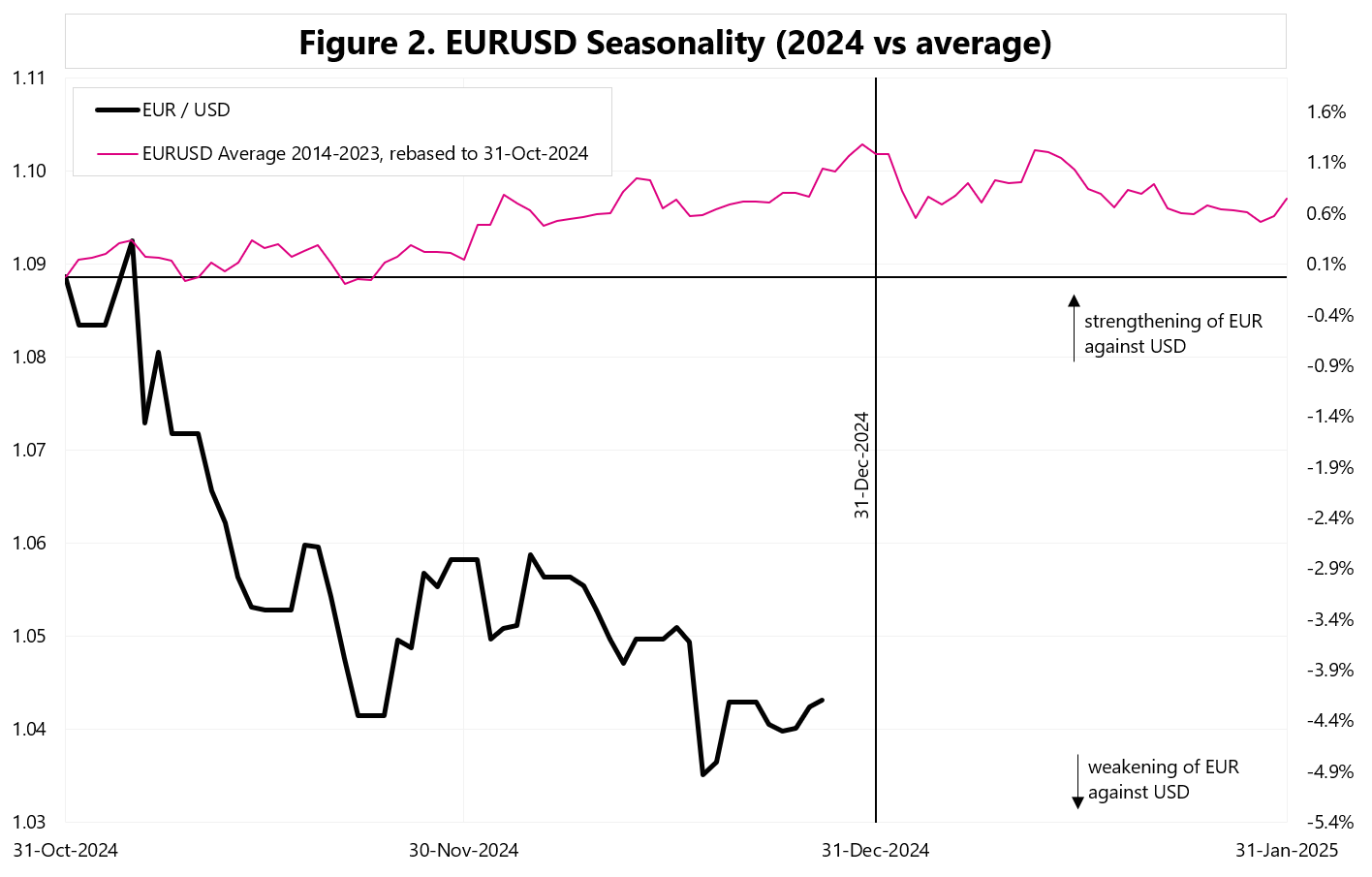

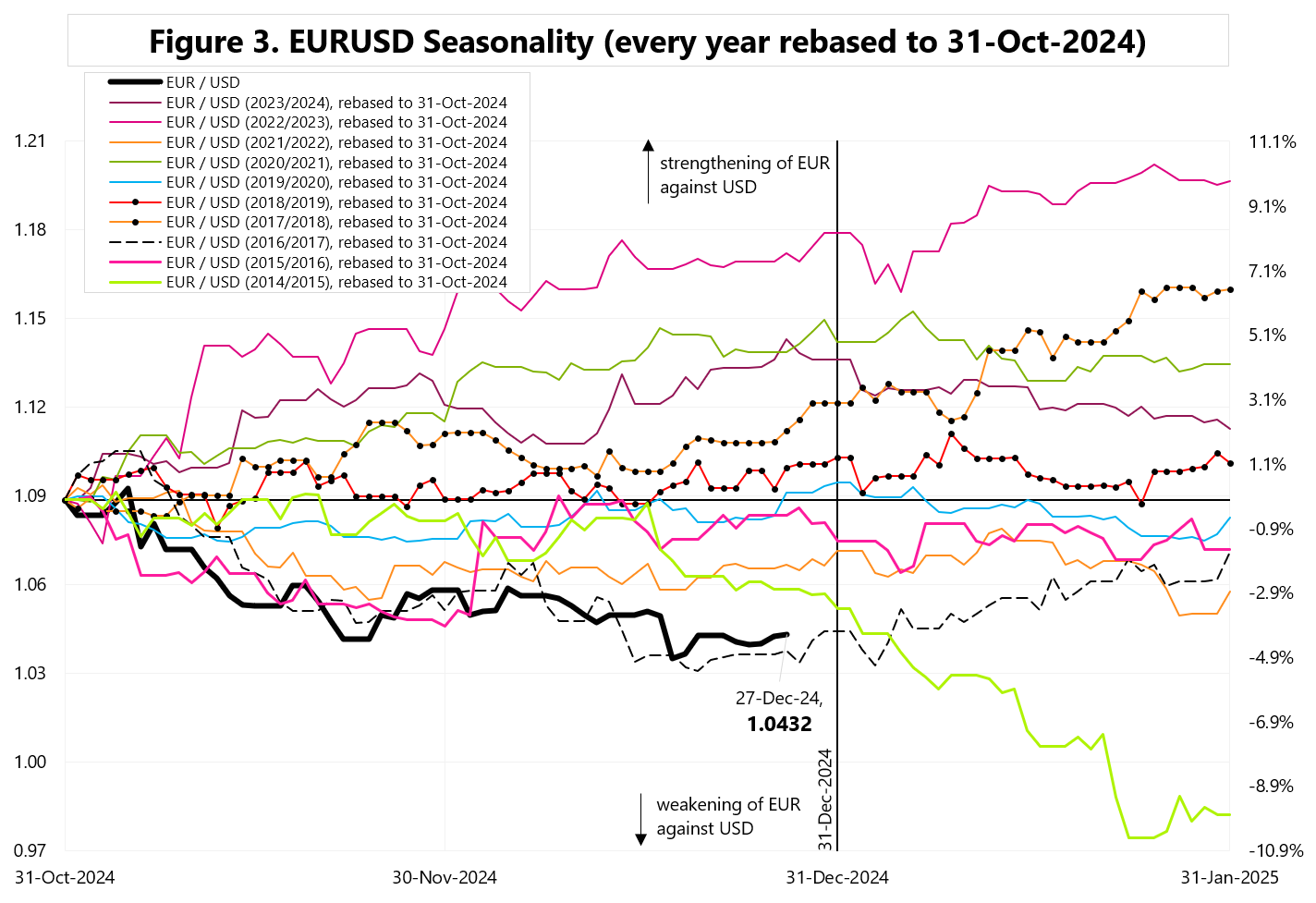

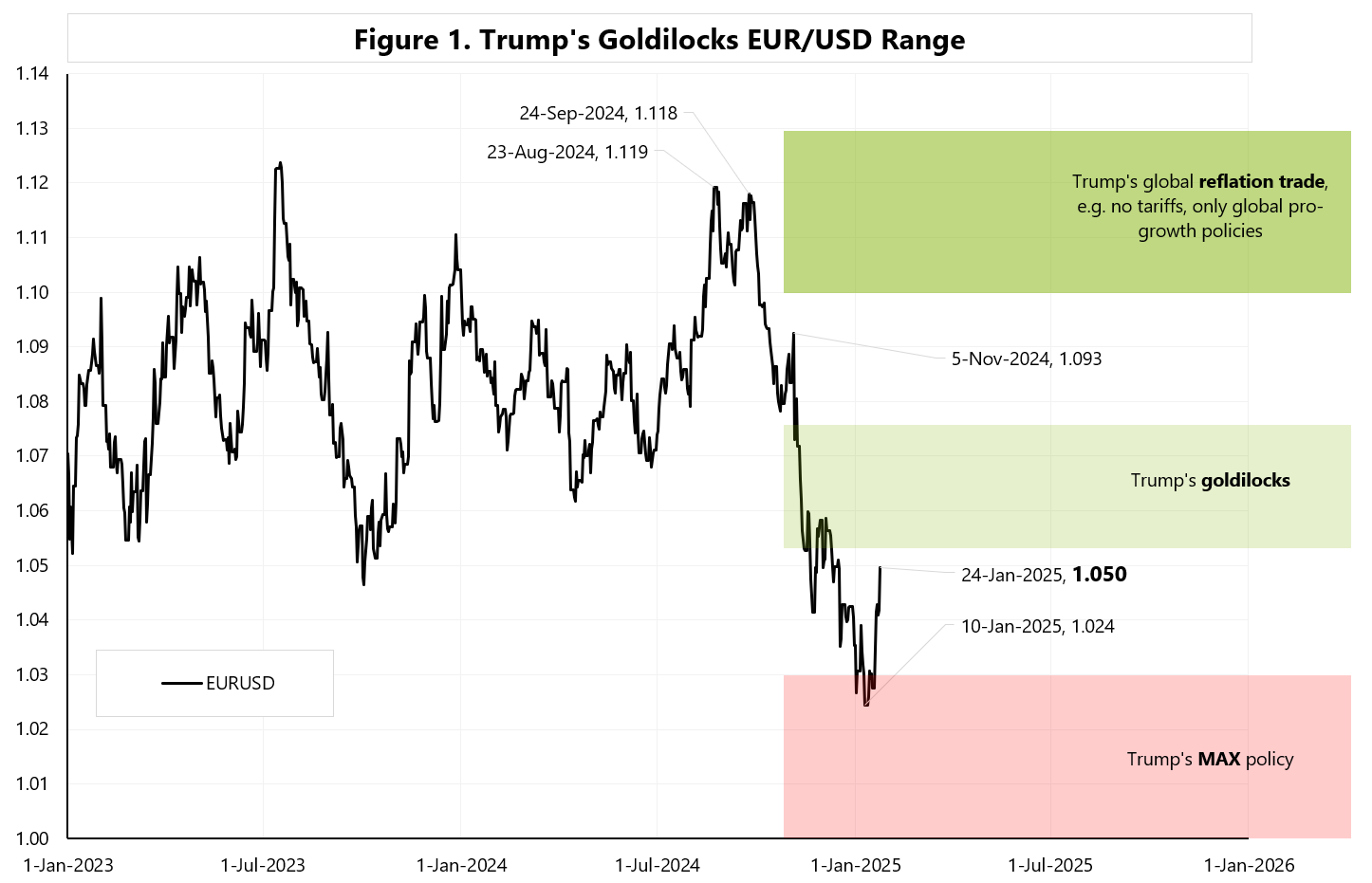

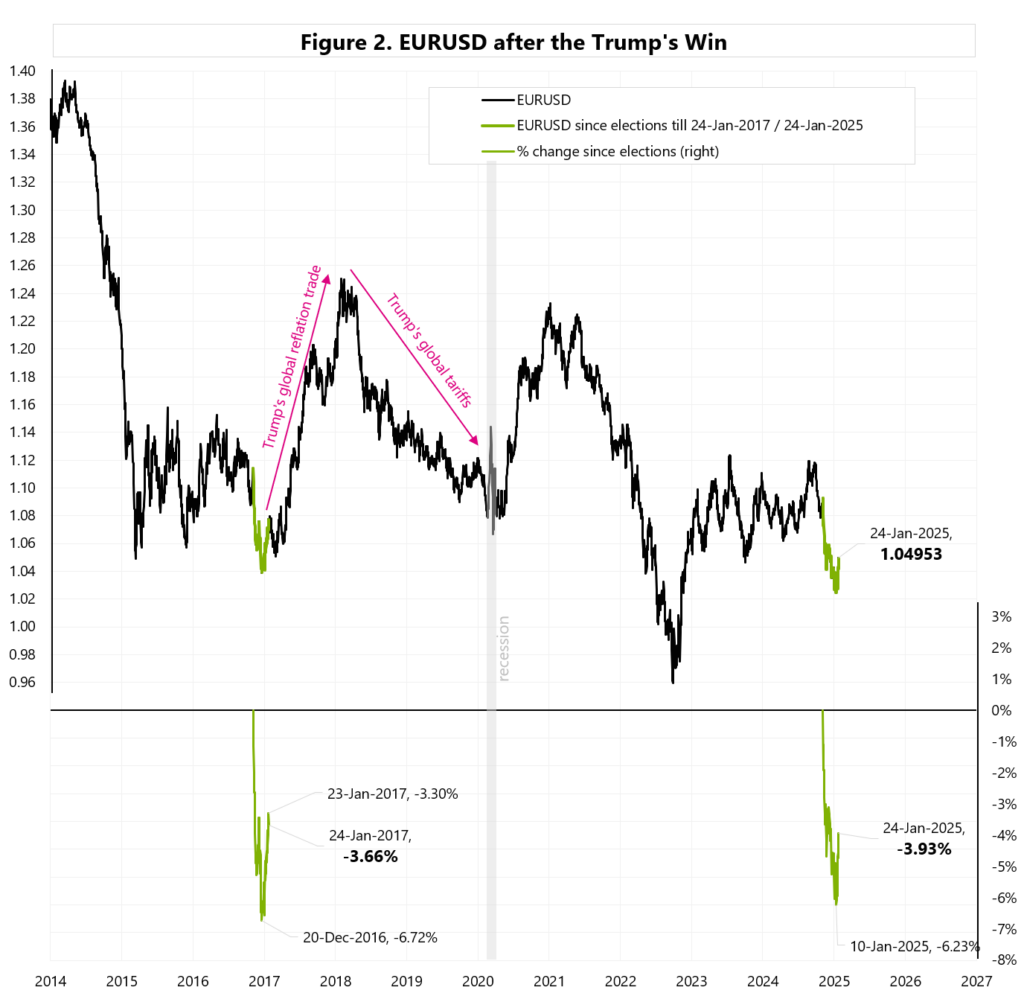

I would rather not count on a repeat of 2017 and a rapid weakening of the dollar, because then we were dealing with a classic global reflation trade – see Figure 2 – and Trump introduced tariffs only on January 22, 2018 and March 1, 2018 – and only then did the markets react to it. Over the next two years, the dollar only strengthened – see Figure 3.

And what is it like today? My working base-case is a Trump’s goldilocks scenario (Q1-Q2 2025) with a tendency for the dollar to strengthen towards parity (Q3-Q4 2025). Of course, markets will be pricing in (sometimes up, sometimes down) what Trump will say in terms of implementing the pro-growth elements of his policy, or the anti-growth elements – so we are going to have a sort of a seesaw, but rather within the range of goldilocks.

Niniejszy materiał jest informacją reklamową. Ma charakter edukacyjno-informacyjny i stanowi wyraz własnych ocen, przemyśleń i opinii autora. Niniejszy materiał służy jedynie celom informacyjnym i nie stanowi oferty, w tym oferty w rozumieniu art. 66 oraz zaproszenia do zawarcia umowy w rozumieniu art. 71 ustawy z dnia 23 kwietnia 1964 r. – Kodeks cywilny (t.j. Dz. U. z 2020 r. poz. 1740, 2320), ani oferty publicznej w rozumieniu art. 3 ustawy z dnia 29 lipca 2005 r. o ofercie publicznej i warunkach wprowadzania instrumentów finansowych do zorganizowanego systemu obrotu oraz o spółkach publicznych (t.j. Dz. U. z 2022 r. poz. 2554, z 2023 r. poz. 825, 1723) czy też oferty publicznej w rozumieniu art 2 lit d) Rozporządzenia Parlamentu Europejskiego i Rady (UE) 2017/1129 z dnia 14 czerwca 2017 r. w sprawie prospektu, który ma być publikowany w związku z ofertą publiczną papierów wartościowych lub dopuszczeniem ich do obrotu na rynku regulowanym oraz uchylenia dyrektywy 2003/71/WE (Dz. Urz. UE L 168 z 30.06.2017, str. 12); Niniejszy materiał nie stanowi także rekomendacji, zaproszenia, ani usług doradztwa. prawnego, podatkowego, finansowego lub inwestycyjnego, związanego z inwestowaniem w jakiekolwiek papiery wartościowe. Materiał ten nie może stanowić podstawy do podjęcia decyzji o dokonaniu jakiejkolwiek inwestycji w papiery wartościowe czy instrumenty finansowe. Informacje zamieszczone w materiale nie stanowią rekomendacji w rozumieniu przepisów Rozporządzenia Parlamentu Europejskiego i Rady (UE) NR 596/2014 z dnia 16 kwietnia 2014 r. w sprawie nadużyć na rynku (rozporządzenie w sprawie nadużyć na rynku) oraz uchylające dyrektywę 2003/6/ WE Parlamentu Europejskiego i Rady i dyrektywy Komisji 2003/124/WE, 2003/125/WE i 2004/72/ WE. (Dz. U UE L 173/1 z dnia 12.06.20114). NDM S.A., nie ponosi odpowiedzialności za prawdziwość, rzetelność i kompletność oraz aktualność danych i informacji zamieszczonych w niniejszej prezentacji. NDM S.A. nie ponosi również jakiejkolwiek odpowiedzialności za szkody wynikające z wykorzystania niniejszego materiału, informacji i danych w nim zawartych. Zawartość materiału została przygotowana na podstawie opracowań sporządzonych zgodnie z najlepszą wiedzą NDM S.A. oraz przy wykorzystaniu informacji i danych publicznie dostępnych, chyba, że wyraźnie wskazano inne źródło pochodzenia danych.

Trump’s Goldilocks ? Read More »