Autor: Jarosław Jamka

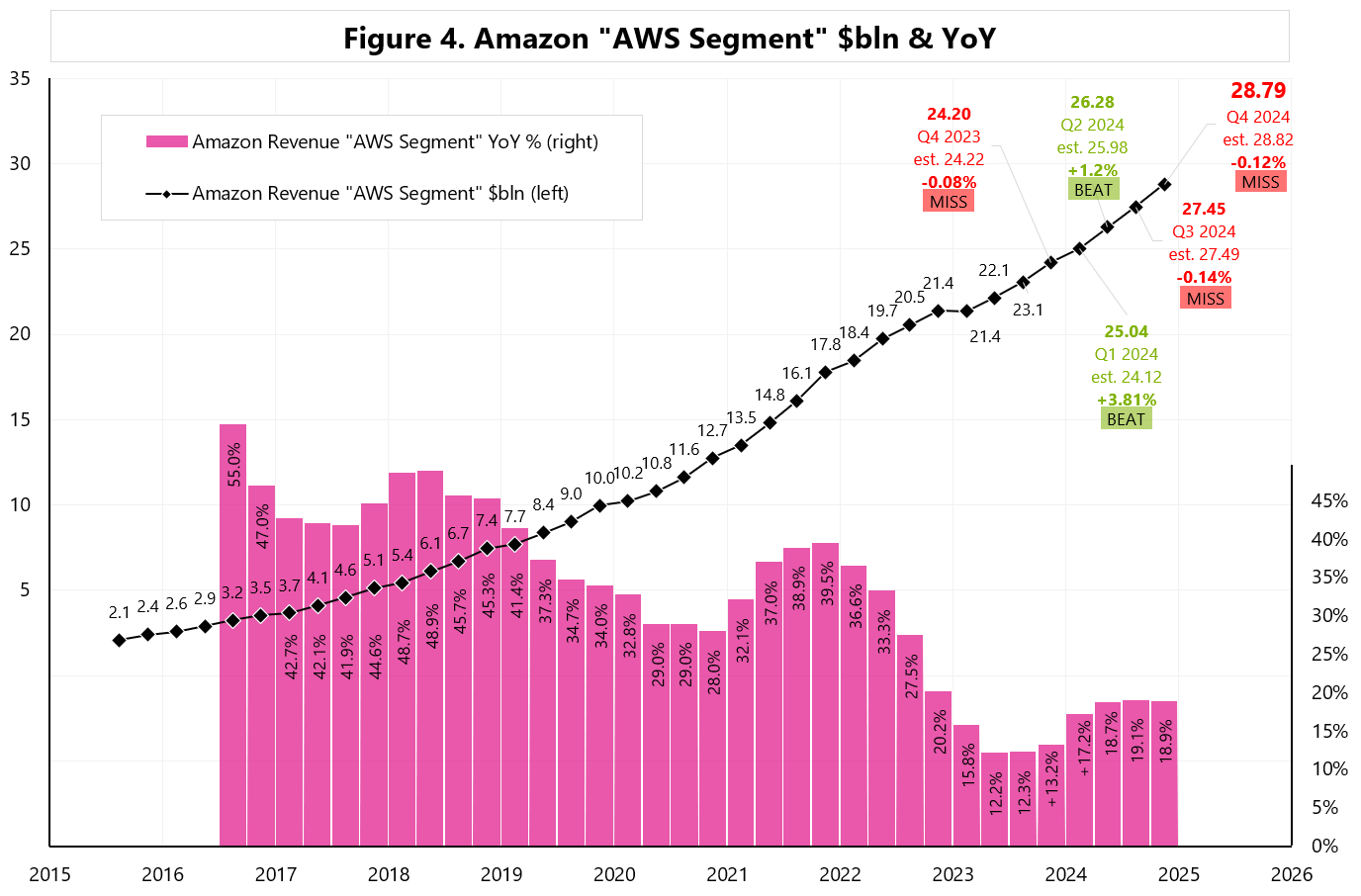

The positives include generally solid results in Q4 2024 and growing margins, while the negatives include slightly weaker AWS revenues in Q4 2024 and weaker-than-expected guidance for Q1 2025.

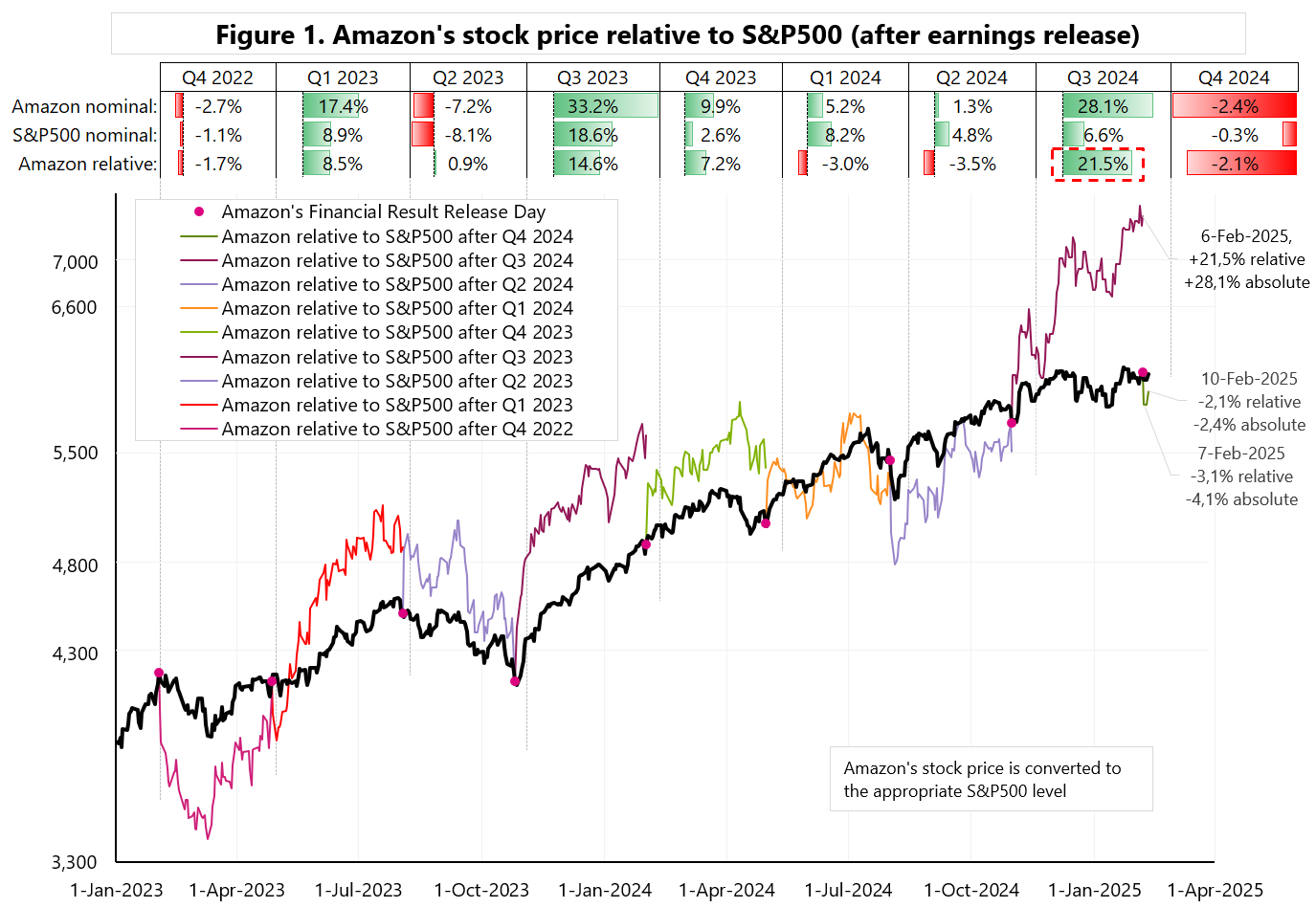

First, Amazon shares beat the S&P500 by 21% between the publication of Q3 2024 and Q4 2024 results (i.e. from October 31, 2024 to February 6, 2025), which is enough to make us expect a pause for now… (such performance also boosted market expectations for Q1 2025).

Figure 1 shows Amazon’s relative performance to the S&P500 after the publication of subsequent quarterly results. As a rule, underperformance is small (as in the period after the publication of Q1 and Q2 2024 results), while overperformance can be large… as a result, Amazon beat the S&P500 by a cumulative 61 percentage points… counting from the publication of Q4 2022 results (i.e. from February 2, 2023 to February 10, 2025 – see Table 1).

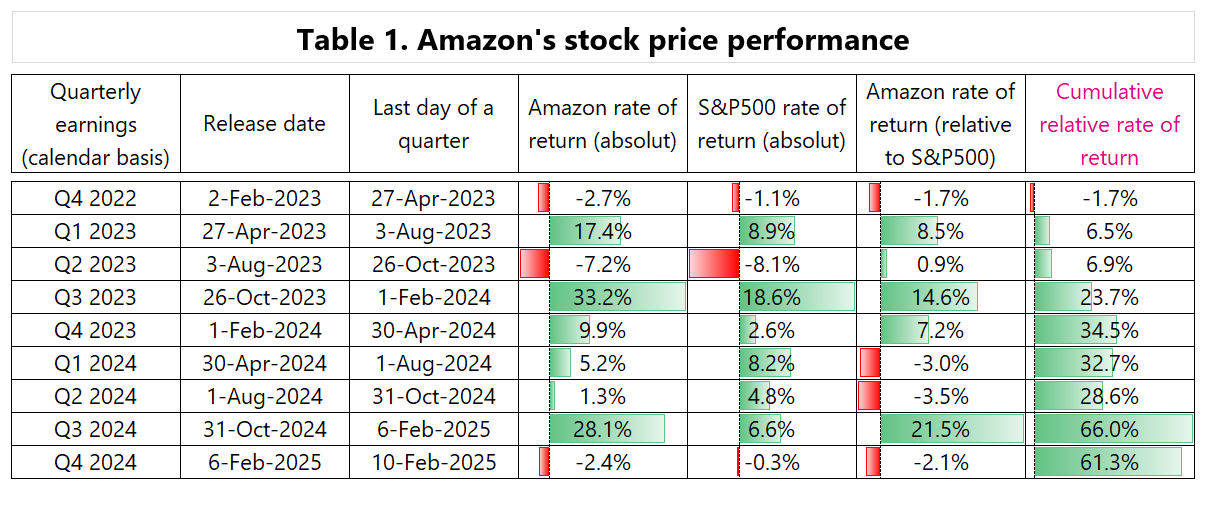

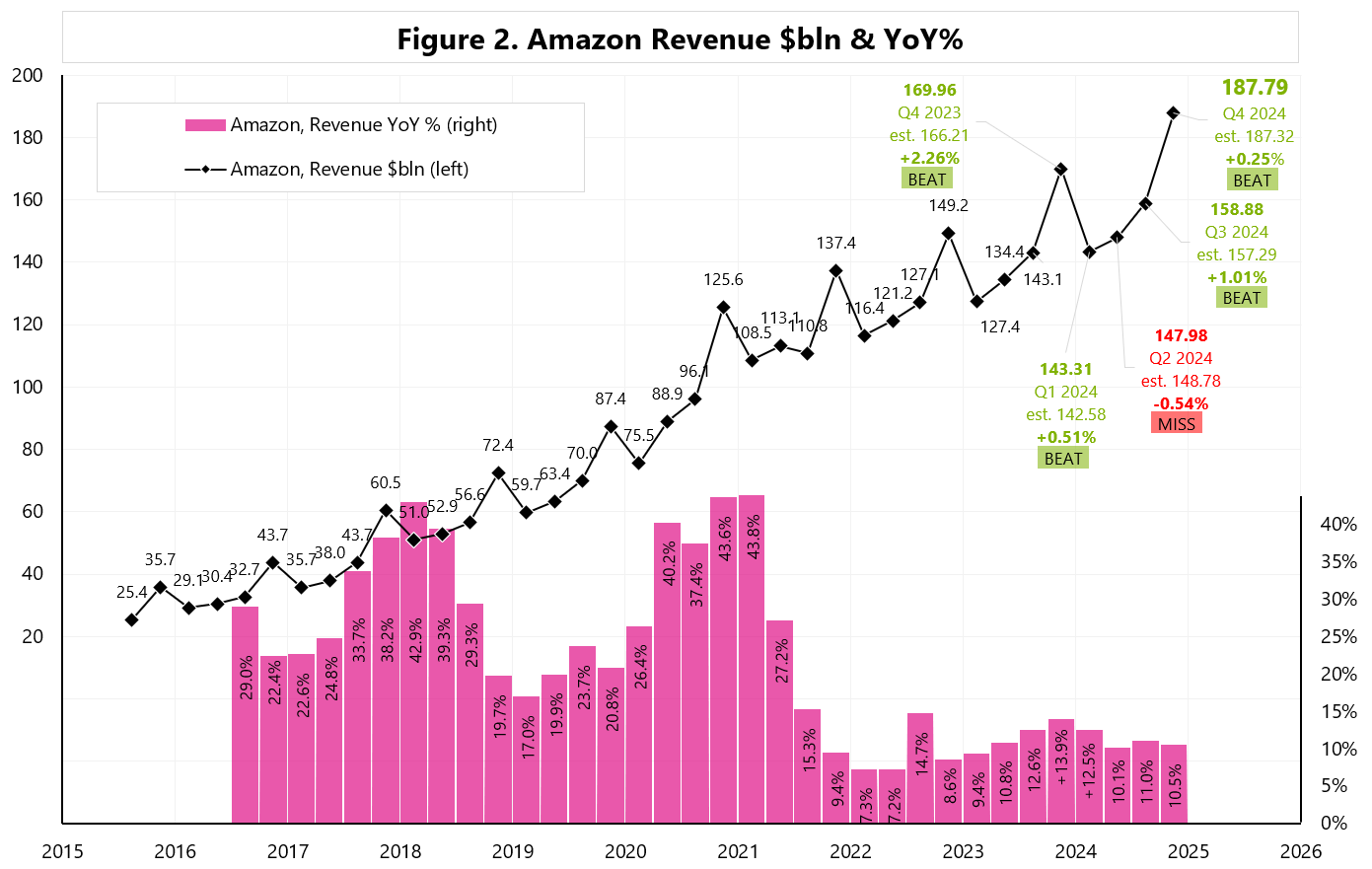

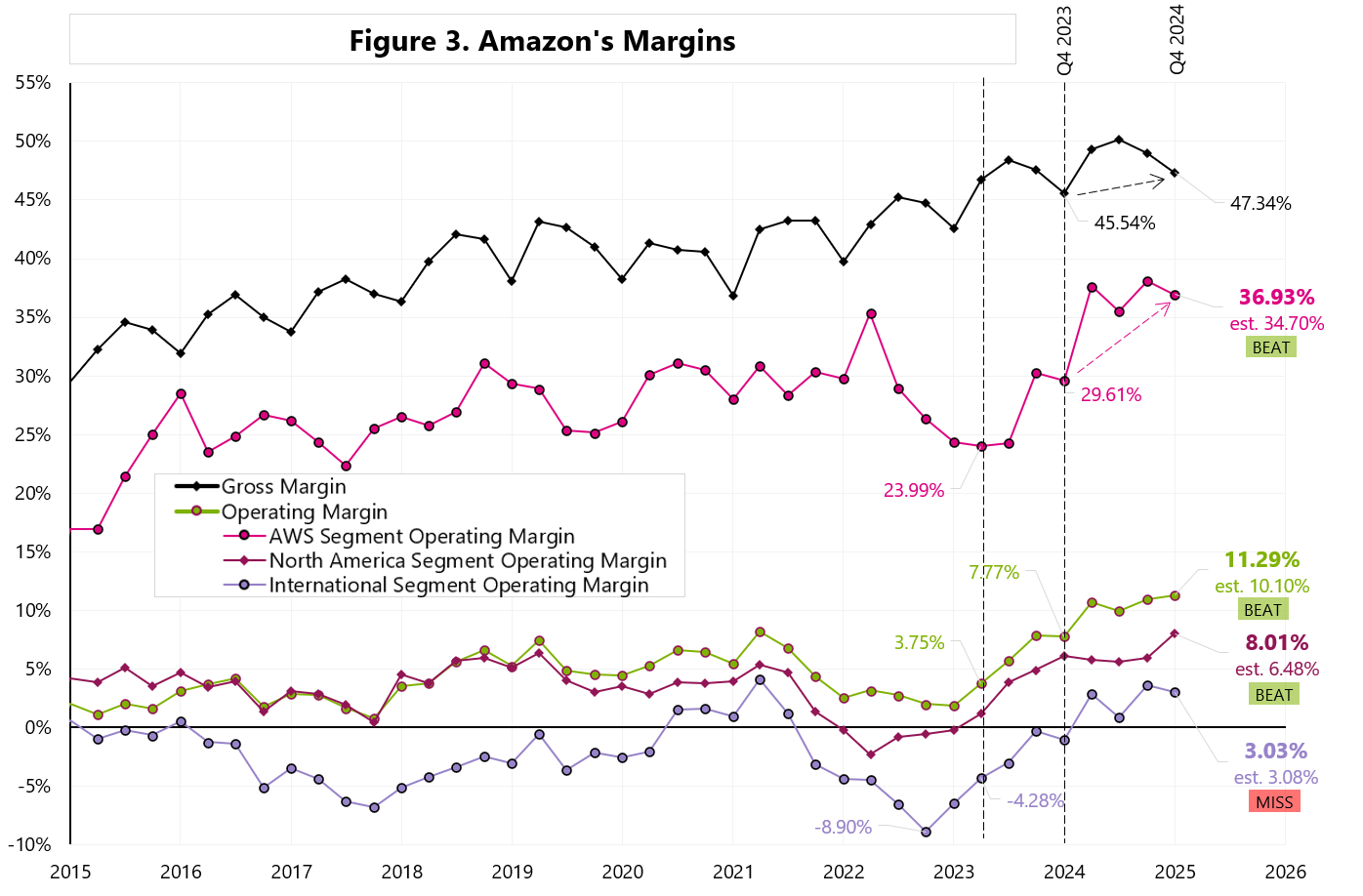

In Q4 2024, Amazon beat expectations regarding total revenue (Figure 2) and margin (Figure 3). AWS did slightly worse (Figure 4). AWS has about a 35% share of the global cloud market.

On the other hand, Amazon disappointed with its guidance for Q1 2025:

– net sales are expected to be $151.0 billion to $155.5 billion, below the estimate of $158.64 billion, and

– operating income $14.0 billion to $18.0 billion, below the estimate of $18.24 billion

CAPEX in 2025 is impressive… as much as $105bn – with Wall Street expecting only $86bn. That’s more in 2025 than Meta ($60-65bn), Alphabet ($75bn) and Mircrosoft (some $88bn in 2025FY).

Andrew R. Jassy , CEO:

“Capital investments were $26.3 billion in the fourth quarter. And we think that run rate will be reasonably representative of our 2025 capital investment rate. Similar to 2024, the majority of the spend will be to support the growing need for technology infrastructure.

This primarily relates to AWS, including to support demand for our AI services, as well as tech infrastructure to support our North America and international segments. Additionally, we’re continuing to invest and capacity for our fulfillment and transportation network to support future growth. We’re also investing in same-day delivery facilities and our inbound network, as well as robotics and automation, to improve delivery speeds and to lower our cost to serve. These capital investments will support growth for many years to come.”

Amazon is quite optimistic about AI, which is “the biggest opportunity”:

“And while it may be hard for some to fathom a world where virtually every app has generative AI infused in it, with inference being a core building block just like compute, storage, and database, and most companies having their own agents that accomplish various tasks and interact with one another, this is the world we’re thinking about all the time. And we continue to believe that this world will mostly be built on top of the cloud with the largest portion of it on AWS. (…) AI represents, for sure, the biggest opportunity since cloud and probably the biggest technology shift and opportunity in business since the Internet”.

And Amazon could have been growing faster:

“It is hard to complain when you have a multibillion-dollar annualized revenue run rate business in AI, like we do, and it’s growing triple-digit percentage year over year. It’s hard to complain. However, it is true that we could be growing faster, if not for some of the constraints on capacity. And they come in the form of, I would say, chips from our third-party partners, come a little bit slower than before with a lot of midstream changes that take a little bit of time to get the hardware actually yielding the percentage healthy and high-quality servers we expect”.

And some comments on DeepSeek:

“First of all, I think like many others, we were impressed with what DeepSeek has done. I think in part impressed with some of the training techniques, primarily in flipping the sequencing of reinforcement training — reinforcement learning being earlier and without the human-in-the-loop. We thought that was interesting ahead of the supervised fine-tuning. We also thought some of the inference optimizations they did were also quite interesting. For those of us who are building frontier models, we’re all working on the same types of things and we’re all learning from one another.

(…) if you run a business like AWS and you have a core belief like we do, that virtually all the big generative AI apps are going to use multiple model types, and different customers are going to use different models for different types of workloads. You’re going to provide as many leading frontier models as possible for customers to choose from. That’s what we’ve done with services like Amazon Bedrock. And it’s why we moved so quickly to make sure that DeepSeek was available both in Bedrock and in SageMaker faster than you saw from others”.

Niniejszy materiał jest informacją reklamową. Ma charakter edukacyjno-informacyjny i stanowi wyraz własnych ocen, przemyśleń i opinii autora. Niniejszy materiał służy jedynie celom informacyjnym i nie stanowi oferty, w tym oferty w rozumieniu art. 66 oraz zaproszenia do zawarcia umowy w rozumieniu art. 71 ustawy z dnia 23 kwietnia 1964 r. – Kodeks cywilny (t.j. Dz. U. z 2020 r. poz. 1740, 2320), ani oferty publicznej w rozumieniu art. 3 ustawy z dnia 29 lipca 2005 r. o ofercie publicznej i warunkach wprowadzania instrumentów finansowych do zorganizowanego systemu obrotu oraz o spółkach publicznych (t.j. Dz. U. z 2022 r. poz. 2554, z 2023 r. poz. 825, 1723) czy też oferty publicznej w rozumieniu art 2 lit d) Rozporządzenia Parlamentu Europejskiego i Rady (UE) 2017/1129 z dnia 14 czerwca 2017 r. w sprawie prospektu, który ma być publikowany w związku z ofertą publiczną papierów wartościowych lub dopuszczeniem ich do obrotu na rynku regulowanym oraz uchylenia dyrektywy 2003/71/WE (Dz. Urz. UE L 168 z 30.06.2017, str. 12); Niniejszy materiał nie stanowi także rekomendacji, zaproszenia, ani usług doradztwa. prawnego, podatkowego, finansowego lub inwestycyjnego, związanego z inwestowaniem w jakiekolwiek papiery wartościowe. Materiał ten nie może stanowić podstawy do podjęcia decyzji o dokonaniu jakiejkolwiek inwestycji w papiery wartościowe czy instrumenty finansowe. Informacje zamieszczone w materiale nie stanowią rekomendacji w rozumieniu przepisów Rozporządzenia Parlamentu Europejskiego i Rady (UE) NR 596/2014 z dnia 16 kwietnia 2014 r. w sprawie nadużyć na rynku (rozporządzenie w sprawie nadużyć na rynku) oraz uchylające dyrektywę 2003/6/ WE Parlamentu Europejskiego i Rady i dyrektywy Komisji 2003/124/WE, 2003/125/WE i 2004/72/ WE. (Dz. U UE L 173/1 z dnia 12.06.20114). NDM S.A., nie ponosi odpowiedzialności za prawdziwość, rzetelność i kompletność oraz aktualność danych i informacji zamieszczonych w niniejszej prezentacji. NDM S.A. nie ponosi również jakiejkolwiek odpowiedzialności za szkody wynikające z wykorzystania niniejszego materiału, informacji i danych w nim zawartych. Zawartość materiału została przygotowana na podstawie opracowań sporządzonych zgodnie z najlepszą wiedzą NDM S.A. oraz przy wykorzystaniu informacji i danych publicznie dostępnych, chyba, że wyraźnie wskazano inne źródło pochodzenia danych.